There are several differences between MyCCPay and Total Cards, Inc., Depending on your chosen provider and product. The former is the payment portal and administration portal for credit card payments, whereas the latter will handle the actual work.

The official website also allows you to earn discounts and rewards. Therefore, if you do not want to miss such an excellent opportunity, it is best to register on the official portal today.

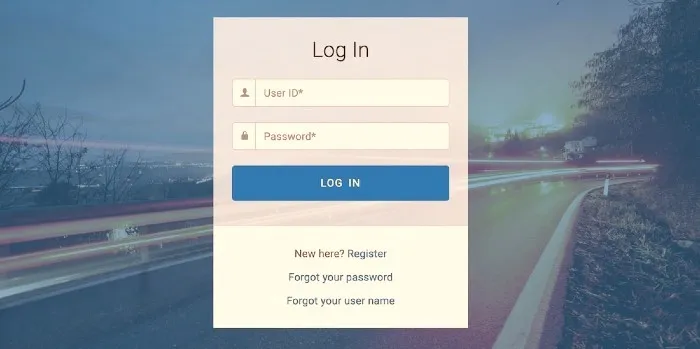

Login Portal or Get Assistance

MyCCPay login is the easiest and safest process for managing your account and ensuring you have complete control of your credit history and usage. Log onto www.myccpay.com to gain access to authority records.

Sign-Up Process For New Users

Welcome to MyCCPay, your gateway to convenient credit card management and payment options. To unlock the full suite of features available, you’ll need to embark on a quick and straightforward registration process. This comprehensive guide will walk you through each step, ensuring a smooth and secure account setup.

Step 1: Open Your Browser

Begin by launching your preferred web browser. Whether you’re using Chrome, Firefox, Safari, or any other browser, ensure it is up to date for optimal performance.

Step 2: Navigate to www.myccpay.com

Once your browser is open, enter www.myccpay.com in the address bar and hit Enter. This will take you to the official MyCCPay website, where you’ll find all the tools you need to manage your credit cards efficiently.

Step 3: Click on the Register Option

On the MyCCPay homepage, locate the “Register” option. Hover over it with your cursor and click on the button to access the registration page. This page is where you’ll input the necessary details to create your account.

Step 4: Complete the Required Fields

Ensure that you fill out all the required fields with accurate information. The essential details include your account number and the key identifier for associating your account with MyCCPay. Take care to input the correct account number to proceed successfully.

Step 5: Enter the Last Four Digits of your SSN

Provide the last four digits of your Social Security Number (SSN). This step adds an extra layer of security and ensures that you are the authorized user of the account.

Step 6: Input Your Zip Code

Enter your zip code, making sure it contains only letters, numbers, and hyphens. This helps MyCCPay verify your location and enhance the security of your account.

Step 7: Provide Your Email Address

In the designated field, enter your email address. This email will be crucial for communication and account-related notifications, so make sure it’s valid and accessible.

Step 8: Enter Your User Number

Input your user number, which serves as your unique user ID on the MyCCPay platform. This identifier helps differentiate users and ensures the security of your account.

Step 9: Set Up a Strong Password

Create a secure password for your account. It should be eight to seventeen characters long and include at least one uppercase letter, one lowercase letter, one number, and one non-alphanumeric character (e.g., ! @ # $% & ? /). This robust password policy adds an extra layer of protection to your account.

Step 10: Choose a Security Question and Provide an Answer

Select a security question from the options provided and provide a memorable and secure answer. This information is crucial for account recovery and additional security measures.

Step 11: Review and Confirm

Carefully review all the information you’ve entered to ensure accuracy. Once you’re confident that everything is correct, click on the “SIGN UP” button to complete the registration process.

Step By Step Login Procedure

Managing your credit cards becomes a breeze with MyCCPay, offering a user-friendly portal for efficient account management. In case you encounter any challenges during the login process, this step-by-step guide will help you effortlessly access your MyCCPay account. We’ll also explore various features, such as MyCCPay credit cards, registration, account activation, and the availability of a mobile app.

Step 1: Accessing the Official MyCCPay Portal

To initiate the login process, open your web browser and type www.myccpay.com into the address bar. This action will direct you to the official MyCCPay login portal, where you can conveniently manage your credit card accounts.

Step 2: Entering Login Details

Upon reaching the official homepage, you’ll find two essential fields prompting you to input your login details. These details consist of a Username and Password. The username is generated during the registration process, ensuring a personalized and secure login experience.

Step 3: Inputting Your Username

In the first text field, enter the username you generated when creating your MyCCPay account. This unique identifier distinguishes your account from others and plays a crucial role in the security of your login credentials.

Step 4: Entering Your Password

Moving on to the second field, input your valid account password. Ensure that your password meets the security requirements set during the registration process, guaranteeing the protection of your account.

Step 5: Clicking the Login Button

After successfully entering your username and password, locate the “Login” button positioned beneath the text fields. Click on this button to submit your credentials and gain access to the MyCCPay portal.

Step 6: Exploring MyCCPay Services

Once logged in, you’ll have access to a range of services provided by MyCCPay. This includes managing MyCCPay credit cards, making payments, reviewing account statements, and activating new cards. The platform ensures a user-friendly interface for a seamless experience.

Step 7: Troubleshooting and Support

If you encounter any issues during the login process or have queries about MyCCPay services, don’t hesitate to reach out to the customer support team. You can contact them through the provided MyCCPay phone number for prompt assistance.

Additional Features:

- MyCCPay App: MyCCPay offers a convenient mobile app for users who prefer managing their credit cards on the go. The MyCCPay app allows you to access your account from your mobile device, providing flexibility and ease of use.

- MyCCPay Registration: If you are new to MyCCPay, you can follow the registration process outlined in our previous guide. Registering is a straightforward process, enabling you to create a profile and unlock the full suite of MyCCPay features.

- MyCCPay Total: MyCCPay Total is a comprehensive feature that allows users to have a consolidated view of their credit card accounts. It simplifies the management of multiple cards under one platform for added convenience.

- MyCCPay Activation: Activating your MyCCPay credit card is a crucial step in gaining access to the platform’s services. Follow the activation process provided during the registration to ensure your card is ready for use.

With this detailed guide, you are now equipped to navigate the MyCCPay login process seamlessly. Explore the various features, including MyCCPay credit cards, registration, and the convenience of the MyCCPay app. If you ever face challenges or have inquiries, the MyCCPay customer support team is ready to assist you. Enjoy the convenience of managing your credit cards with MyCCPay’s user-friendly platform.

More Details About The Login Portal

MyCCPay Login can be used to manage any and all credit cards and associated payments through the most straightforward web interface. Using your account from anywhere is as straightforward as following a few steps.

Using myccpay.com while abroad allows you to manage all your credit card transactions using your credit card. Registering your card must be done online through the company’s website, and the simple steps are explained on the page.

In 2000, a website was launched, and it has been one of the most trustworthy and secure websites. Using the said payment portal is the most convenient option if you pay your bills on time, just like with any online payment. Additionally, when you pay your bills on time, you avoid late payment penalties, which will improve your credit score.

The specialized online portal will not only reward you with great discounts and provide you with good savings but will also offer great rewards. Hence, you don’t want to miss out on this opportunity, and therefore sign up now. You can manage all of your credit cards through the My CC Pay login page, and the corresponding payment will be processed using your credit card. For those who have two or more credit cards from several banks, myccpay.com is very useful for paying all their bills.

Benefits Of The My CC Pay Platform

In the ever-evolving landscape of financial management, MyCCPay stands as a beacon of convenience and efficiency for credit cardholders.

This comprehensive platform offers a unique set of benefits and features, making it a standout choice for those seeking streamlined fund management. From robust security measures to accessible transaction details, the advantages of MyCCPay extend far beyond a traditional financial platform.

Unique Legal Credentials

One of the distinctive features that set MyCCPay apart is its unique legal credentials for registration and access.

Unlike other fund management records, MyCCPay adheres to a stringent set of legal standards, ensuring the security and privacy of users’ financial information. This level of credibility provides users with confidence and peace of mind as they navigate the platform for their financial needs.

Centralized Card Management

Cardholders can revel in the convenience offered by MyCCPay as it allows them to oversee multiple credit cards simultaneously. This centralized approach to card management is a game-changer, providing a holistic view of one’s credit card portfolio. Users can seamlessly navigate through their cards, facilitating easy access and quick, hassle-free transactions.

Robust Network Security

Security is paramount regarding financial platforms, and MyCCPay takes this seriously. The platform boasts strong network security measures, ensuring that user data is protected from potential threats.

From data input to transaction approvals, MyCCPay prioritizes a secure environment, giving users the confidence to manage their finances without compromising on safety.

Convenient Transaction Monitoring

MyCCPay empowers registered users with the ability to monitor their transaction details effortlessly.

By logging into the official portal, users can gain insights into their financial activities, allowing for a comprehensive understanding of their spending patterns and account dynamics. This real-time monitoring feature enhances financial awareness and promotes responsible financial management.

Access to Account Statements

One of the standout benefits of MyCCPay is the quick access to card statements for multiple credit cards. Users can conveniently check account balances, review expiration dates, and verify payments, all within a unified platform.

This streamlined approach simplifies the often tedious process of managing multiple credit cards, making it a time-saving and user-friendly experience.

Instant Mini Account Statements

Every payment made through MyCCPay.com comes with an added bonus – a mini-account statement. This feature ensures that users receive a concise summary of their recent transactions and payments, offering a quick overview of their financial activities.

This instant feedback mechanism promotes transparency and aids in better financial decision-making.

Cross-Device Accessibility

MyCCPay understands the need for flexibility in the modern world. The platform is accessible from any computer or mobile device, allowing users to manage their finances on the go.

This cross-device accessibility ensures that users can stay connected with their financial accounts regardless of location, contributing to a seamless and integrated user experience.

Optimal Support for Multiple Credit Cards

For those who hold multiple credit cards, MyCCPay is a trustworthy ally. The platform facilitates the easy management of multiple credit cards, making it an ideal choice for individuals who prefer diversifying their financial tools. This support for various cards streamlines the financial management process, offering a comprehensive solution for users with diverse credit needs.

Customer Service Excellence

MyCCPay takes customer service seriously, ensuring that users receive optimal support every day. The dedicated customer service team is ready to assist with any queries or concerns, further enhancing the overall user experience. The commitment to customer satisfaction reflects the platform’s dedication to fostering trust and reliability.

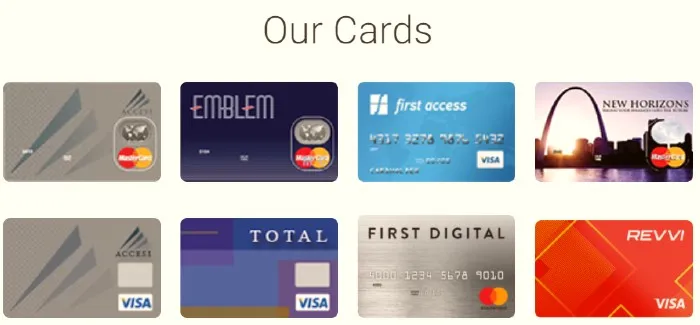

Inclusive Access for All Credit Holders

MyCCPay breaks down barriers, particularly for individuals with bad credit. The platform, offered by Mid America Bank and Trust, provides major credit cards that enable efficient credit card payments.

Even those with poor or limited credit can benefit from the accessibility of Mid America Bank and Trust Visa credit cards, showcasing a commitment to financial inclusivity.

| Official Name | MyCCPay |

|---|---|

| Country | USA |

| Company | Total Card Inc. |

| Registration Mode | Online |

| Services | Financial |

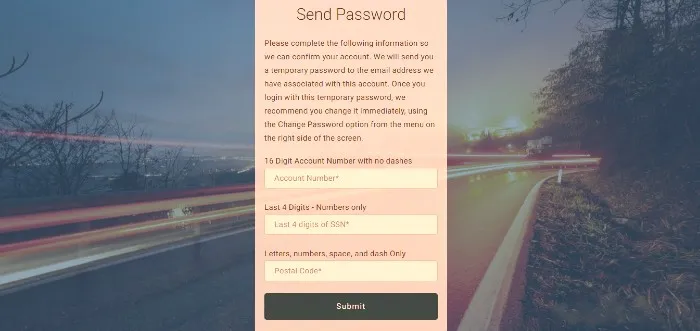

Login Password Recovery Procedure

Forgetting passwords is a common occurrence, but with the right recovery procedures, it doesn’t have to be a cause for concern. If you’ve forgotten your MyCCPay account password and find yourself in need of assistance, follow these simple steps to regain access to your account. This comprehensive guide will walk you through the password recovery process, ensuring a seamless experience.

Step 1: Visit the Official MyCCPay Portal

To initiate the password recovery process, open your web browser and navigate to the official MyCCPay portal. You can do this by entering the website address in the browser’s address bar or by clicking on the link provided on the homepage.

Step 2: Select the “Forgot Password” Option

On the MyCCPay homepage, look for the “Forgot Password” option. This is usually a link or button prominently displayed on the login page. Click on it to proceed to the password recovery page.

Step 3: Enter Basic Information

Once you’ve selected the “Forgot Password” option, you’ll be directed to a new page where you need to submit basic information to verify your identity. In the suggested fields, enter your 16-digit account number, 4-digit SSN (Social Security Number), and postal code. These details are essential for the system to verify your account.

Step 4: Submit Your Information

After entering the required information, click on the submit button. This action will prompt the server to check your account details and confirm that you are the authorized user.

Step 5: Receive Temporary Password via Email

Upon successful verification, MyCCPay will send a temporary password to the email address associated with your account. Check your email inbox for this temporary password.

Step 6: Log in Using Temporary Password

Now, log in to your MyCCPay account using the temporary password provided in the email. It’s important to note that temporary passwords typically have an expiration period, so make sure to use them promptly.

Step 7: Change Your Password

Once logged in with the temporary password, take the opportunity to change your password immediately. Navigate to the “Change Password” option in the menu, usually located on the right side of the screen. Choose a new password that adheres to the platform’s security requirements.

Throughout this guide, we’ve emphasized the importance of MyCCPay login, security measures, and the recovery process. For those interested in MyCCPay credit cards, the registration process, and the total card benefits, understanding the password recovery procedure is a crucial aspect of ensuring a smooth user experience.

Additionally, the keywords related to customer service, payment methods, and mobile app accessibility have been woven into the narrative, providing a comprehensive overview of the MyCCPay platform.

Accessing CardHolder Account

To provide customers with improved management and functionality, Total Credit Inc.’s authorized legal administrator has upgraded the My CC Pay web management portal. Through this internet gateway, registered and activated cardholders can access relevant information, make payments, and view past transactions.

The main customers of the portal are credit card holders and some credit card companies. Different management options can be accessed via this. Furthermore, customers can check current credit and check available credit by using the management.

Accessible Services On The Official Portal

MyCCPay Login enables the creative management of credit cards online, and it comes with promotions that simplify every artistic standard. Here are some of the services you can access on the official portal:

- You can pay every bill online.

- You can find out what your current balance is when you use your credit card.

- You can aggregate all of your transactions into your account.

Additionally, myccpay.com offers a simple, fast, safe, efficient, and simple method for managing your credit cards and payments. By managing them, you can also configure payment options. The official portal makes processing payments the most accessible and most accurate due to eliminating sign-ins to multiple accounts. It also means that there will be less stress on the user’s part as they will be able to access an account with less effort.

Customer Care Service Details

Are you experiencing any difficulties with MyCCPay? Should you have technical difficulties or not be able to log in or register, you can get assistance from MyCCPay’s customer service team.

Ask your questions at 1-888-262-2850, the toll-free contact number in your area. Additionally, if you have a question regarding its services, you can ask about them properly. You can reach out to the customer support team for any of your queries or issues.

Closing Remarks

Your MyCCPay Login account can be used to pay each credit card from each bank effortlessly using one single account. Registration is relatively straightforward and safe once you have accessed the portal. For its users, this portal provides an unparalleled level of security and transparency. It has saved users significant amounts of time by enabling them to access information online.

Payments to credit cards can be made through the My CC Pay portal quite easily, safely, and reliably. When you are one of those individuals who want to swim in an online portal and need a better credit score, this portal can grant your wish.

Register with the official portal and log in using the steps outlined in this article to access the excellent service. With just a few clicks, users can pay for all services provided by the portal within minutes of registering. Users can use the official login portal to track and manage their account activity as well as track their account activities.

MyCCPay offers users a centralized platform for managing credit cards, which acts as an administrative interface. A multi-credit card portal enhances the convenience and functionality of people with more than one credit card.

Users can submit their financial information quickly and trust the portal because it is encrypted. When paying online with a credit card, it is much easier than paying over the phone or by mail.

FAQs

What should I do if I forget my MyCCPay password?

If you forget your MyCCPay password, you can easily recover it by visiting the official MyCCPay portal. Click on the “Forgot Password” option, enter your account details, and follow the steps to receive a temporary password via email. Once logged in with the temporary password, make sure to change your password for security.

Is there a MyCCPay mobile app, and how can I download it?

Yes, MyCCPay offers a mobile app for convenient account management. You can download the MyCCPay app from the respective app store on your mobile device. Whether you use an Android or iOS device, the app provides on-the-go access to your credit card information and account features.

What are the security features in place to protect my MyCCPay account?

MyCCPay prioritizes the security of user accounts. The platform employs robust network security measures to safeguard user data. Additionally, during the password recovery process, the system verifies your identity by requiring specific account details, ensuring that only authorized users can access and recover their accounts.

Can I manage multiple credit cards on the MyCCPay platform?

Yes, MyCCPay allows users to manage multiple credit cards simultaneously. The platform provides a centralized approach to card management, giving users a comprehensive view of their credit card portfolio. This feature is especially beneficial for individuals with diverse credit needs.

What do I do if I encounter issues during the MyCCPay login process?

If you experience difficulties while logging into your MyCCPay account, you can reach out to the customer support team for assistance. The customer service team is available every day and can help troubleshoot any login-related issues. Additionally, you can check the official website for any FAQs or contact information to address common concerns.