MyCCPay stands as a pivotal platform in the realm of credit card management, offering a gateway to multiple credit cards, all under the proficient management of Total Card, Inc. (TCI).

In navigating the intricate landscape of credit, the establishment of an online account emerges as a cornerstone, providing users with an efficient means to stay in control of their credit usage. As the financial landscape evolves, MyCCPay.com has become a beacon of convenience, offering users a streamlined approach to credit card management.

Total Card, Inc. plays a pivotal role as the operator of MyCCPay Payment Access, a crucial distinction from the process of issuing credit cards. To illustrate, consider the First Access Visa Card, a credit card issued by The Bank of Missouri but accessed through MyCCPay.

This underscores the unique relationship wherein consumers obtain their credit card from the issuing institution, while Total Card Inc. serves as the conduit through which payments are seamlessly managed.

The significance of establishing an online account is underscored by the dynamic nature of financial transactions. An online account with MyCCPay ensures not only accessibility but also provides a centralized hub for users to monitor and regulate their credit activities. This proactive approach is instrumental in avoiding pitfalls and fostering responsible financial habits.

Accessing MyCCPay.com marks the gateway to a comprehensive suite of tools designed for efficient account management. Navigating the login page unlocks a realm of possibilities, allowing users to track expenditures, make timely payments, and gain valuable insights into their credit standing. The user-friendly interface of MyCCPay.com is tailored to empower individuals to manage their credit journey with ease, fostering financial literacy and responsibility.

In essence, this introduction sets the stage for a detailed exploration of MyCCPay, Total Card, Inc., and the array of credit cards accessible through this platform. It highlights the pivotal role of an online account in modern credit management and outlines the user-friendly process of accessing MyCCPay.com for seamless account management.

MyCCPay Payment Access: Total Card, Inc.

Total Card, Inc. stands as the backbone of MyCCPay Payment Access, playing a central role in facilitating efficient credit card management. It is crucial to clarify Total Card, Inc.’s distinctive role as the operator of MyCCPay, emphasizing that it is not involved in the issuance of credit cards.

Instead, Total Card, Inc. serves as the intermediary platform through which users seamlessly navigate their credit transactions.

The distinction between card issuance and payment services is paramount in understanding the dynamics of MyCCPay. While credit cards like the First Access Visa Card may be issued by financial institutions such as The Bank of Missouri, Total Card, Inc. steps in as the service provider facilitating payments and account management.

This nuanced separation ensures that users can obtain credit from the issuing institution while benefiting from the user-friendly interface and services offered by Total Card, Inc. through MyCCPay.

As an illustrative example, consider the First Access Visa Card, which is issued by The Bank of Missouri. Although users acquire credit cards directly from the bank, MyCCPay becomes the conduit through which payments are made, transactions are tracked, and account management is streamlined.

This synergy between card issuance and payment services exemplifies the efficiency and collaboration inherent in the Total Card, Inc. and MyCCPay partnership.

MyCCPay Portal: Accessible Cards

The MyCCPay portal stands out for its inclusive approach, accommodating a diverse array of credit and Visa cards, which contributes to its widespread accessibility among users.

Recognizing the dynamic needs of individuals in managing their financial portfolios, MyCCPay ensures support for a variety of credit and Visa cards, fostering a comprehensive and user-centric platform.

One of the standout features of MyCCPay is its emphasis on the convenience of online payments. The platform’s payment infrastructure is designed to simplify the often intricate process of managing credit transactions.

Users can effortlessly navigate through the portal to make secure online payments, providing them with a seamless experience and promoting financial responsibility.

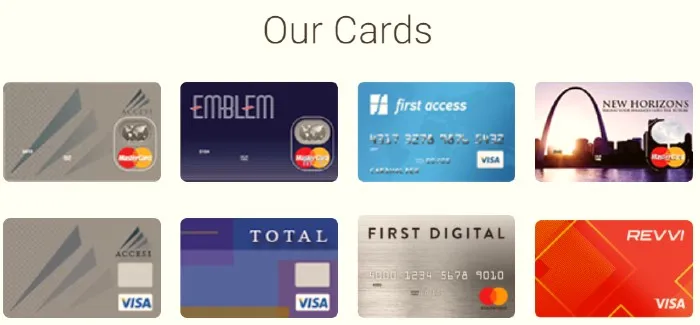

Among the notable credit cards featured on the MyCCPay portal, the First Access Visa Card takes a prominent position. This card, alongside others like Total Visa Credit cards, Emblem Master Card, New Horizon Master Card, and Access Master Card, exemplifies the diverse options available to users.

MyCCPay becomes the centralized hub where users can efficiently manage payments, track transactions, and gain insights into their credit activities for each of these featured cards.

The inclusion of such a varied selection of credit cards on the MyCCPay portal not only caters to different financial preferences but also reinforces the platform’s commitment to offering a one-stop solution for users to manage their credit effectively.

Popular Cards and Application Process

Within the spectrum of credit cards accessible through MyCCPay, certain cards have gained notable popularity, and among them, the First Access Visa and Total Visa Credit Card emerge as key contenders.

These cards are particularly favored for their accessibility, allowing individuals with low credit scores to secure a credit card through the application process facilitated by MyCCPay.

The application process for these popular cards is designed to be inclusive, enabling individuals with less-than-ideal credit histories to obtain a credit card and embark on the path to financial recovery.

This emphasis on accessibility aligns with MyCCPay’s commitment to providing financial solutions for a diverse range of users.

However, it’s crucial to address a notable concern associated with these popular cards—their relatively high annual fees. While the First Access Visa and Total Visa Credit Card may be more accessible for those with lower credit scores, the trade-off comes in the form of elevated annual fees.

This aspect warrants careful consideration by potential cardholders, as the fees could potentially impact their financial resources. As such, individuals exploring these cards through MyCCPay are encouraged to weigh the benefits against the costs, ensuring that the chosen card aligns with their financial goals and capabilities.

Alternatives with Different Fee Structures

Understanding the average customer reviews for cards with varying fee structures aids in forming realistic expectations. Positive reviews may highlight the affordability and perks of cards with lower annual fees, while critical feedback may shed light on any drawbacks associated with popular but higher-cost options.

This holistic approach empowers users to make informed decisions based on the experiences of their peers, ensuring that the selected credit card aligns with their expectations and financial priorities.

Overview of credit cards with lower annual fees:

Beyond the popular choices like the First Access Visa and Total Visa Credit Card, MyCCPay offers a spectrum of alternatives with varying fee structures.

Several credit cards on the platform come with lower annual fees, providing users with cost-effective options for managing their finances. These alternatives cater to individuals seeking affordability without compromising on essential features.

Comparison of popular and less popular cards in terms of fees and features:

When assessing credit cards available through MyCCPay, it becomes crucial to conduct a comprehensive comparison between popular choices and less renowned alternatives.

While popular cards may boast higher visibility, less popular options often come with distinct advantages, such as lower annual fees and competitive features. By comparing both categories, users can pinpoint a credit card that not only suits their financial situation but also aligns with their specific preferences and needs.

For instance, a less popular card might have a lower annual fee, making it an attractive option for users who prioritize minimizing costs. Simultaneously, users should consider the features offered by each card, such as rewards programs, introductory APRs, and credit-building opportunities.

This comparative analysis allows individuals to make well-informed decisions that align with their unique financial goals.

Average customer reviews for cards with different fee structures:

Customer reviews serve as a valuable resource in gauging the practicality and satisfaction associated with different credit cards. MyCCPay users can benefit from perusing reviews to gain insights into the experiences of other cardholders.

By focusing on reviews specific to fee structures, users can discern patterns regarding customer satisfaction, potential drawbacks, and overall value for money.

Choosing the Right Card for Your Needs

By approaching credit card selection through these bullet points, users can efficiently navigate the MyCCPay Portal, ensuring that the chosen card aligns with their financial circumstances and long-term goals.

- Factors to consider when selecting a credit card:

- Evaluate interest rates, annual fees, rewards programs, credit limits, and additional perks.

- Align features with individual financial habits and priorities.

- Tailor choices based on specific needs, such as travel rewards or credit-building opportunities.

- Analyzing individual financial situations to determine the most suitable card:

- Conduct a self-assessment considering income, credit score, spending habits, and financial goals.

- Tailor choices based on credit history, with options available for both credit-building and established credit.

- Anticipate future financial needs to ensure the selected card aligns with long-term objectives.

- Guidance on navigating the MyCCPay Portal for card selection:

- Explore detailed information for each card, including terms, conditions, and associated fees.

- Utilize comparison tools on the portal to contrast different cards side by side.

- Take advantage of resources such as FAQs, customer support, and educational materials for a well-informed decision-making process.

MyCCPay Portal Options and Features

The MyCCPay portal stands out not only for the breadth of options it offers but also for the effectiveness of its features in simplifying credit card management.

Exploring the various options available on the MyCCPay Portal:

- The MyCCPay portal offers users a diverse range of options, creating a comprehensive platform for efficient credit card management. Users can explore features such as account settings, payment history, and transaction details. The portal allows for seamless navigation through different sections, enabling users to access the specific information they need effortlessly.

Features for effective credit card management and payment:

- MyCCPay provides an array of features designed to streamline credit card management. Users can make online payments securely, schedule automatic payments to avoid late fees, and set up alerts for upcoming payments or changes in account status. The platform also facilitates the tracking of expenditures, offering insights into spending patterns and helping users maintain control over their financial activities.

- Additionally, users can view current balances, available credit, and recent transactions, allowing for real-time monitoring of their credit card accounts. The inclusion of such features enhances transparency and empowers users to make informed decisions about their financial commitments.

User-friendly interface and tools for account monitoring:

- The MyCCPay portal boasts a user-friendly interface, ensuring that both seasoned and new users can navigate the platform with ease. The layout is intuitive, with clear menus and prompts guiding users through various functionalities. This simplicity extends to account monitoring tools, offering graphical representations of spending patterns, payment histories, and credit utilization.

- Account monitoring tools provide users with the ability to track changes in their credit standing, helping them stay informed about their financial health. The user-friendly interface and monitoring tools contribute to a positive user experience, making it convenient for individuals to manage their credit cards effectively without the need for extensive financial expertise.

Benefits and Challenges of MyCCPay and Total Card, Inc

Advantages of using MyCCPay for credit card management:

MyCCPay offers users unparalleled convenience in managing their credit cards. The online platform allows users to access their accounts at any time, facilitating real-time monitoring, payment scheduling, and account adjustments.

The platform supports a variety of credit and Visa cards, providing users with a range of choices to suit their financial needs. This diversity ensures that users can find a credit card that aligns with their preferences, credit history, and specific financial goals.

MyCCPay streamlines the payment process, allowing users to make secure online payments easily. The platform’s features include options for setting up automatic payments, reducing the risk of late fees, and enhancing overall financial management.

Challenges such as high annual fees and customer satisfaction concerns:

One notable challenge associated with certain credit cards accessible through MyCCPay, such as the First Access Visa and Total Visa Credit Card, is the presence of high annual fees. While these cards offer accessibility to individuals with lower credit scores, the annual fees may pose a financial burden, impacting users’ overall satisfaction.

Some users have expressed concerns related to customer satisfaction, particularly with popular cards that come with higher fees. While these cards may offer specific benefits, user reviews indicate that the overall satisfaction may be tempered by the financial implications of annual fees.

Addressing potential issues and providing recommendations

MyCCPay offers numerous benefits in terms of convenience and card variety, users must be aware of potential challenges, particularly associated with high annual fees.

- Fee Comparison: To address concerns about high annual fees, users are encouraged to conduct a thorough comparison of credit cards available through MyCCPay. This involves assessing the fees, features, and benefits of different cards to identify options that align with individual financial priorities.

- Exploring Alternatives: Users who are sensitive to high annual fees may explore alternative credit card options with lower fees and comparable benefits. MyCCPay supports a variety of cards, and users can leverage this diversity to find a card that meets their financial requirements without compromising on essential features.

- Customer Support Engagement: In cases where customer satisfaction concerns arise, engaging with MyCCPay’s customer support can provide valuable insights and potential solutions. Users are encouraged to communicate their concerns, seek clarification on fees, and explore potential adjustments to enhance their overall experience.

Conclusion

MyCCPay emerges as a versatile platform, centralizing credit card management under Total Card, Inc. Key points highlighted include its user-friendly interface, diverse card options, and efficient payment processing.

The flexibility and choices provided by MyCCPay underscore its commitment to meeting varied financial needs. As users navigate the platform, it is crucial to consider factors such as annual fees and individual financial preferences.

In making informed decisions, users can optimize their credit card experience, ensuring that MyCCPay remains a valuable tool in fostering financial responsibility and convenience.