MyCCPay offers an easy-to-use system that connects and manages all your credit card transactions. Before starting the registration process, the internet connection you are using must be strong. All it takes is access to a stable computer with existing working software. The website can be visited conveniently from any location in the world.

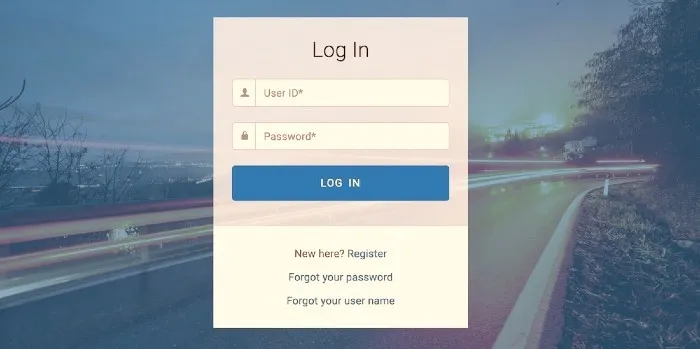

Below the login tab, there are different options for you. These include the register button from where you can sign up on the portal. Forgot username allows you to recover your forgotten password. While forgot password option will enable you to reset your account password.

Official Login or Get Assistance

Pre-requisites for MyCCPay Login

In the rapidly evolving landscape of digital banking and financial management, the MyCCPay Login portal stands out as a user-friendly platform, offering clients the convenience of accessing their accounts from anywhere in the world. However, to make the most of this innovative tool, users must adhere to certain prerequisites to ensure a smooth and secure login experience.

Strong Internet Connection Requirement

One of the fundamental requirements for accessing the MyCCPay portal is a robust and stable internet connection. The significance of a strong internet connection cannot be overstated in the context of online financial transactions.

A reliable connection ensures that users can seamlessly navigate the portal, review their credit card information, and perform various transactions without interruptions. This requirement emphasizes the portal’s commitment to providing real-time access to financial data, underscoring the need for users to have a dependable internet connection to enjoy uninterrupted services.

Compatible Devices and Software

The MyCCPay portal has been designed to be compatible with a variety of devices and software to accommodate a diverse user base. Whether users prefer to access their accounts from a desktop computer, laptop, tablet, or smartphone, the portal is optimized for a responsive and user-friendly experience across different platforms.

Additionally, the compatibility extends to various operating systems and web browsers, ensuring that users can choose the device and software that align with their preferences while still enjoying the full functionality of the MyCCPay portal. This adaptability reflects the commitment to inclusivity and user convenience, allowing individuals to engage with the portal using the devices and software they are most comfortable with.

Global Accessibility of the Website

The MyCCPay portal takes pride in its global accessibility, allowing users to log in and manage their credit card accounts from virtually any location worldwide. This level of accessibility is a key feature, catering to the increasingly interconnected and mobile nature of modern life.

Whether users find themselves at home, in the office, or traveling abroad, they can rely on the MyCCPay portal to be accessible and responsive. This global reach is facilitated by the portal’s infrastructure, which is designed to handle diverse internet networks and provide a consistent user experience irrespective of geographical location.

MyCCPay’s commitment to global accessibility reflects the recognition that users may need to manage their finances on the go, and the portal is equipped to meet these evolving needs.

User Options on the Login Page

In the dynamic realm of online account management, the MyCCPay Login portal distinguishes itself by providing users with a range of user-friendly options on its login page. These options are strategically designed to cater to the diverse needs of users, ensuring a seamless and secure experience. Let’s delve into the three key user options available on the MyCCPay Login page:

Register Button for New Users

The inclusion of a prominent “Register” button on the MyCCPay Login page serves as an open invitation for new users to join the platform.

This user-friendly feature simplifies the onboarding process, allowing individuals to create accounts and access the myriad benefits offered by MyCCPay. Clicking on the “Register” button initiates a straightforward registration process, prompting users to provide essential information such as personal details, contact information, and security credentials.

The intuitive design of this registration option reflects MyCCPay’s commitment to inclusivity, making it easy for individuals to become part of the platform and harness its powerful features for managing their credit card transactions.

Forgot Username Option for Password Recovery

For users who may have forgotten their usernames, the MyCCPay portal offers a convenient “Forgot Username” option. This feature streamlines the process of recovering forgotten usernames, eliminating the frustration that can arise from memory lapses.

By clicking on this option, users are guided through a series of steps that typically involve verifying personal information to ensure account security. Once the user’s identity is confirmed, the system provides the forgotten username, enabling a smooth reentry into the MyCCPay portal.

This thoughtful feature exemplifies MyCCPay’s user-centric approach, prioritizing user experience and security in equal measure.

Forgot Password Option for Account Password Reset

The “Forgot Password” option is a crucial element of the MyCCPay Login page, offering a lifeline to users who may find themselves locked out of their accounts due to forgotten passwords.

This option is a testament to MyCCPay’s commitment to user empowerment and security. Clicking on “Forgot Password” initiates a secure password reset process, often involving identity verification steps to ensure the rightful account owner is making the request. Users can then create a new password, restoring access to their accounts.

By providing this option, MyCCPay demonstrates a proactive approach to user support, recognizing that password-related issues can happen to anyone and offering a straightforward solution.

Login Process

The MyCCPay Login process is a gateway to a world of digital financial management, offering users a streamlined and secure experience. From visiting the official website to accessing account information, each step is designed with user convenience and data security in mind. Let’s unravel the intricacies of the MyCCPay Login process:

Visiting the Official Website at www.myccpay.com

The journey begins with users navigating to the official MyCCPay website at www.myccpay.com. This intentional web address serves as a direct entry point to the secure portal, ensuring users land on the authentic platform.

MyCCPay’s commitment to transparency and user trust is evident from the outset, as users are encouraged to verify the website’s URL to guard against phishing attempts. This initial step sets the tone for a user-centric experience, emphasizing the importance of starting the financial management journey on the right digital footing.

Using Any Internet-Connected Device

MyCCPay understands the diverse ways in which users engage with digital platforms. Therefore, the portal is designed to be compatible with any internet-connected device, whether it’s a desktop computer, laptop, tablet, or smartphone.

This adaptability ensures that users have the flexibility to choose the device that aligns with their preferences and lifestyle. Whether at home, in the office, or on the go, MyCCPay users can enjoy a consistent and responsive experience, underscoring the portal’s commitment to accessibility in the digital age.

Entering Credentials (User ID and Password)

Once on the official website, users are prompted to enter their credentials – a unique user ID and a password associated with their MyCCPay account. This layer of security ensures that only authorized individuals gain access to sensitive financial information.

MyCCPay encourages users to create strong, unique passwords and safeguard their user IDs to enhance account security. The emphasis on password protection is a testament to MyCCPay’s dedication to user privacy and data integrity.

Clicking Login to Access the Account

After entering the required credentials, users simply click the “Login” button to initiate the authentication process. This straightforward action signifies the completion of the user input phase and signals the system to validate the provided information.

The “Login” button serves as a portal gateway, granting users access to their personalized financial dashboard where they can review credit card transactions, check balances, and perform various account-related activities.

Verification Process and Database Match

Behind the scenes, MyCCPay employs a robust verification process to ensure the security of user accounts. This may involve cross-referencing the entered credentials with the information stored in the system’s database.

The verification process is a critical step in safeguarding against unauthorized access and potential security breaches. If the provided details match the database records, users are granted access to their accounts, ushering in a secure and personalized digital financial experience.

Benefits of MyCCPay Login

The MyCCPay Login portal stands as a beacon of convenience and empowerment in the realm of digital financial management, offering users a plethora of benefits that transcend traditional banking experiences. Let’s delve into the multifaceted advantages that users can harness upon logging into their MyCCPay accounts:

- One of the standout features of MyCCPay is its commitment to providing users with round-the-clock access to their accounts. The portal transcends the constraints of traditional banking hours, allowing users to log in and manage their finances at any time, day or night. This 24/7 account access is a game-changer, enabling users to stay connected with their financial information on their terms, fostering a sense of control and flexibility over their credit card management.

- MyCCPay empowers users with the ability to check their credit card balances with ease. Through a simple login process, individuals can gain instant insights into their current credit card balances, facilitating informed financial decision-making. Whether tracking daily expenses or ensuring adequate funds for upcoming transactions, the balance check feature enhances financial awareness and empowers users to stay on top of their credit card accounts effortlessly.

- Understanding the importance of credit scores in today’s financial landscape, MyCCPay offers users the capability to view their credit scores directly through the portal. This feature provides valuable insights into users’ creditworthiness, helping them gauge their financial standing and make informed decisions regarding loans, mortgages, or other credit-related matters. The integration of credit score viewing amplifies the holistic financial management experience MyCCPay aims to deliver.

- The MyCCPay portal serves as a comprehensive financial archive, allowing users to review their transaction history at their convenience. With a few clicks, users can access a detailed record of their credit card transactions, categorizing expenditures and providing a clear overview of their spending patterns. This feature enhances financial transparency, aids in budgeting, and facilitates the identification of any unauthorized or unusual transactions, contributing to a secure and well-informed financial journey.

- Simplifying the often cumbersome process of bill payments, MyCCPay integrates a user-friendly bill payment functionality. Users can conveniently settle their credit card bills directly through the portal, eliminating the need for external payment platforms or manual processes. This not only saves time but also adds a layer of convenience, promoting timely payments and fostering financial discipline.

- MyCCPay extends beyond basic transaction histories by offering users direct access to their bank statements. This feature provides a comprehensive overview of all financial activities associated with the credit card account. Users can download, view, and save their statements, facilitating record-keeping and serving as a valuable resource for financial planning, budgeting, and auditing.

- The MyCCPay portal goes above and beyond by offering an array of additional features that enhance the overall user experience. These may include personalized account settings, security features, alerts for unusual activities, and customer support functionalities. The inclusion of these features underscores MyCCPay’s commitment to providing a comprehensive and user-centric financial management platform.

MyCCPay as a Centralized Credit Card Management Platform

MyCCPay distinguishes itself as a centralized credit card management platform that not only simplifies financial transactions but also prioritizes security and efficiency. Let’s explore the key attributes that position MyCCPay as a central hub for credit card management:

MyCCPay recognizes the evolving financial landscape and caters to users with multiple credit cards. The platform serves as a unified space where users can seamlessly manage and monitor all their credit card accounts in one place.

This multi-credit card management feature eliminates the need for users to navigate through various portals, providing a consolidated view of their financial portfolio. Whether users hold multiple cards from different issuers or share joint accounts, MyCCPay streamlines the management process for a holistic and convenient experience.

Security is paramount in the realm of online financial management, and MyCCPay prioritizes this by implementing a secure login process. Users undergo authentication steps, including the entry of a unique user ID and password, ensuring that only authorized individuals gain access to sensitive financial information.

This secure login process is fortified by additional layers of security measures, such as CAPTCHA verification or multifactor authentication, further safeguarding user accounts from unauthorized access attempts. MyCCPay’s commitment to a secure login process builds trust and confidence among users, reinforcing the platform as a reliable financial management solution.

Recognizing the sensitivity of financial data, MyCCPay employs robust encryption protocols to assure users of the highest level of data security. Advanced encryption mechanisms, such as SSL (Secure Sockets Layer) or TLS (Transport Layer Security), are implemented to encrypt data during transmission, preventing unauthorized interception or tampering.

This encryption level assurance extends to the storage of user data within the platform, ensuring that personal and financial information remains confidential and protected from potential cyber threats. MyCCPay’s dedication to maintaining state-of-the-art encryption technology underscores its commitment to user privacy and data security, instilling confidence in users to trust the platform with their financial information.

Online Credit Card Payment Advantages

As a testament to the evolution of financial transactions, MyCCPay not only simplifies credit card management but also brings forth a host of advantages for users opting for online credit card payments. Let’s delve into the key benefits that underscore the advantages of this digital payment method:

- One of the standout advantages of utilizing MyCCPay for online credit card payments is the significant time and energy savings it offers. Traditional payment methods, such as writing and mailing checks or visiting physical banking locations, are time-consuming and require additional effort.

- With MyCCPay’s online payment functionality, users can swiftly and securely settle their credit card bills from the comfort of their homes or any location with internet access. This convenience not only reduces the burden of manual processes but also frees up time for users to focus on other aspects of their lives, enhancing overall efficiency in managing financial obligations.

- MyCCPay prioritizes user convenience from the moment of registration, enabling quick and efficient credit card payments immediately after the portal sign-up process. Once users have registered on the portal, they can seamlessly navigate to the bill payment section and initiate transactions without unnecessary delays.

- This quick payment feature ensures that users can promptly address their financial obligations, contributing to timely payments and potentially avoiding late fees. MyCCPay’s commitment to a user-centric experience is evident in this streamlined process, offering a hassle-free way to manage and settle credit card payments promptly.

- The efficiency of financial transactions is a hallmark of MyCCPay’s online credit card payment system. Through a secure and user-friendly interface, users can effortlessly schedule recurring payments, set payment reminders, and track their payment history—all in one centralized platform.

This enhanced efficiency not only simplifies the credit card management process but also contributes to better financial planning and organization. MyCCPay’s dedication to providing a comprehensive suite of tools for users enhances their financial literacy and control, fostering a more streamlined and effective approach to managing credit card transactions.

Conclusion

In conclusion, MyCCPay emerges as a beacon of modern financial convenience, offering 24/7 access, multi-card management, and robust security features.

Users benefit from time-saving online payments, quick registration processes, and efficient financial transactions. This comprehensive platform ensures a streamlined and secure credit card management experience.

We encourage users to embrace the advantages of MyCCPay, navigating its user-friendly interface for seamless transactions. Trust in the secure online environment provided by MyCCPay, empowering you to manage your credit cards with confidence, efficiency, and peace of mind. Elevate your financial journey with MyCCPay today.