When it comes to managing your finances, it’s important to find ways to simplify the process and make it more efficient. By doing so, you can gain better control over your money and make informed decisions about your financial future. Technology has played a significant role in streamlining financial management, making it easier than ever to stay on top of your financial health.

The Importance of Financial Management

Effective financial management is crucial for individuals and families alike. It involves creating a budget, tracking expenses, and making informed decisions about saving and investing. By managing your finances well, you can achieve financial stability, reduce stress, and work towards your long-term goals. It’s essential to have a clear understanding of your income, expenses, debts, and savings to make informed financial choices.

Streamlining Your Financial Life with Technology

Technology has revolutionized the way we handle our finances. With the advent of mobile apps, managing your money has become more convenient and accessible. The myccpay app is one such tool that can simplify your financial life. This app allows you to manage your credit cards, track your expenses, set budgets, and enhance your financial security, all from the palm of your hand.

By leveraging the power of technology, the myccpay app enables you to have a comprehensive view of your credit cards in one place. Instead of juggling between multiple accounts and websites, you can access all your credit card information through a single app. This not only saves time but also helps you stay organized and on top of your financial obligations.

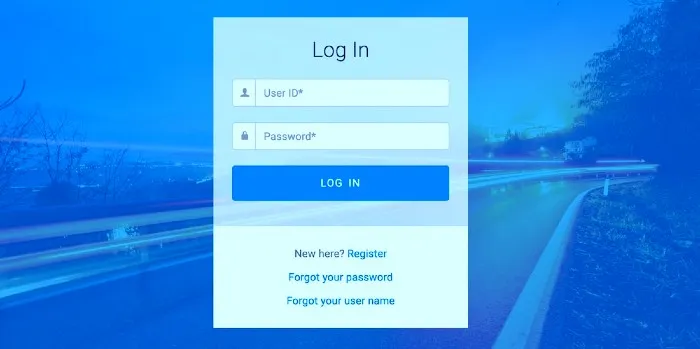

To get started with the myccpay app, you can easily register and create an account. Once logged in, you’ll have access to features such as monitoring your balances and transactions, making payments, setting up alerts, and tracking your financial goals. The myccpay app provides a user-friendly interface that makes navigating through its various functionalities a breeze.

In the upcoming sections, we will delve deeper into the key features and benefits of the myccpay app, exploring how it can help you effectively manage your credit cards, budget your expenses, enhance financial security, and embrace convenience and accessibility. Keep reading to discover how the myccpay app can transform your financial life.

Introducing the myccpay App

In this modern age of technology, managing your finances has become easier than ever before. The myccpay app is a powerful tool that can simplify your financial life and provide you with the convenience and control you need. Let’s take a closer look at what the myccpay app is and explore its key features.

What is myccpay?

The myccpay app is a mobile application designed to help you manage your credit cards efficiently. It allows you to access your credit card accounts, view balances, make payments, and monitor transactions, all in one convenient place. With the myccpay app, you can take control of your financial life with ease.

To get started with the myccpay app, you will need to create an account and link your credit cards. The app provides a user-friendly interface, making it easy for you to navigate and access the information you need. Whether you’re on the go or at home, you can conveniently manage your credit cards using the myccpay app.

Key Features of the myccpay App

The myccpay app offers several key features that can transform the way you manage your finances. Here are some of its notable features:

-

Account Access: With the myccpay app, you can access your credit card accounts anytime, anywhere. This means you no longer have to rely on a computer or visit multiple websites to stay updated on your credit card information.

-

Balance Monitoring: The app allows you to easily check your credit card balances, giving you a real-time snapshot of your financial situation. This feature enables you to stay on top of your expenses and make informed financial decisions.

-

Transaction Tracking: Tracking your credit card transactions is made effortless with the myccpay app. You can review your recent transactions, ensuring accuracy and identifying any unauthorized activity promptly.

-

Payment Management: Making payments has never been easier. The myccpay app provides a convenient platform for you to pay your credit card bills securely. You can set up recurring payments or make one-time payments, helping you avoid late fees and maintain good financial standing.

-

Account Security: The myccpay app prioritizes your security. It employs robust security measures to protect your personal and financial information. You can have peace of mind knowing that your data is safeguarded from unauthorized access. For more information on security, visit the myccpay com page security article.

-

Customer Support: The myccpay app offers customer support and assistance to address any queries or concerns you may have. If you encounter any issues or need guidance, the app provides access to customer support representatives who can help you navigate through the app and resolve any problems.

The myccpay app empowers you to take control of your credit card accounts, providing you with a comprehensive platform to manage your finances effectively. By utilizing the features offered by the app, you can streamline your financial journey and simplify your life.

Managing Your Credit Cards

When it comes to managing your credit cards, the myccpay app offers a range of features to help you stay on top of your finances and make the most out of your credit card accounts. Let’s explore two key functionalities: monitoring balances and transactions, and making payments to avoid late fees.

Monitoring Balances and Transactions

With the myccpay app, you can conveniently monitor the balances and transactions of your credit cards in one place. Gone are the days of logging into multiple accounts or waiting for paper statements to arrive in the mail. The app provides a clear overview of your credit card balances, allowing you to track your spending and stay within your credit limits.

In addition to balances, the app also provides detailed transaction histories. You can review individual transactions, including the date, time, and merchant information. This feature enables you to identify any unauthorized or fraudulent charges promptly. By regularly monitoring your balances and transactions, you can maintain a clear understanding of your financial standing and identify any discrepancies that may require attention.

Making Payments and Avoiding Late Fees

Late fees can be a real hassle and can negatively impact your credit score. The myccpay app offers a convenient solution by allowing you to make payments directly from your mobile device. Simply link your bank account or add a debit card to initiate payments quickly and securely.

By utilizing the app’s payment feature, you can ensure that your credit card payments are made on time, reducing the risk of late fees and potential damage to your credit history. Set up payment reminders or schedule recurring payments to further streamline your financial management. This way, you can focus on other aspects of your life without worrying about missed due dates or incurring unnecessary charges.

Remember, it’s important to maintain a healthy credit card payment habit by paying at least the minimum amount due each month. This helps you avoid late fees and maintain a positive credit history. For a detailed overview of your credit card accounts and payment options, log in to the myccpay app or visit the myccpay website.

The myccpay app simplifies credit card management, providing you with a convenient platform to monitor your balances and transactions, as well as make payments in a timely manner. By utilizing these features, you can take control of your credit cards, stay organized, and avoid unnecessary fees.

Budgeting and Expense Tracking

When it comes to managing your finances effectively, tracking your spending and setting budgets are essential steps to take. The myccpay app offers features that can assist you in these areas, helping you gain better control over your financial goals.

Tracking Your Spending

The myccpay app provides a convenient way to track your spending. By linking your credit card accounts to the app, you can easily monitor your transactions in one centralized location. The app categorizes your expenses automatically, allowing you to see where your money is going at a glance.

With the ability to view your spending patterns and trends, you can identify areas where you may be overspending or where you can make adjustments to save more. This insight into your spending habits empowers you to make informed financial decisions and take steps towards achieving your financial goals.

Setting Budgets and Financial Goals

Another valuable feature of the myccpay app is the ability to set budgets and financial goals. By establishing a budget, you can allocate specific amounts of money to different expense categories, such as groceries, entertainment, or utilities. The app helps you stay on track by providing real-time updates on your spending within each category, allowing you to make adjustments as needed.

Setting financial goals is crucial for long-term financial success. Whether you’re saving for a down payment on a house, planning a vacation, or paying off debt, the myccpay app allows you to set goals and track your progress. With a clear view of your financial goals and the ability to monitor your progress, you can stay motivated and make the necessary adjustments to achieve your objectives.

The myccpay app serves as a valuable tool for budgeting and expense tracking, offering a comprehensive overview of your financial activity. By utilizing these features, you can gain better control over your finances and work towards achieving your financial aspirations. Remember to regularly review your budgets and goals, making adjustments as necessary to ensure that you stay on the path to financial success.

Enhancing Financial Security

When it comes to managing your finances, security is of paramount importance. The myccpay app prioritizes the safety and protection of your financial information, offering robust account security measures and advanced fraud prevention features.

Account Security Measures

The myccpay app implements stringent security measures to safeguard your personal and financial data. These measures include:

-

Secure Login: To access your account, the myccpay app requires a unique username and password. It is crucial to create a strong, unique password and avoid sharing it with anyone to prevent unauthorized access.

-

Multi-Factor Authentication: To add an extra layer of security, the myccpay app may utilize multi-factor authentication. This means that in addition to your username and password, you may be required to provide additional verification, such as a one-time password sent to your registered mobile number or email address.

-

Encryption: The myccpay app employs encryption technology to protect your data during transmission. This ensures that your information remains confidential and cannot be intercepted by unauthorized individuals.

-

Secure Connection: When using the myccpay app, it is essential to ensure that you are connected to a secure network, such as a trusted Wi-Fi network or a cellular data connection. Avoid using public Wi-Fi networks, as they may pose security risks.

Alerts and Notifications for Fraud Prevention

The myccpay app provides a range of alerts and notifications to help you stay informed about your account activity and detect potential fraudulent transactions. These features include:

-

Transaction Alerts: You can set up transaction alerts to receive notifications whenever a transaction is made using your credit cards. This allows you to quickly identify any unauthorized activity and take appropriate action.

-

Balance Threshold Alerts: By setting balance threshold alerts, you can receive notifications when your credit card balance exceeds a specified limit. This helps you stay on top of your finances and avoid excessive spending.

-

Suspicious Activity Alerts: The myccpay app utilizes advanced fraud detection algorithms to identify suspicious activity on your account. If any unusual transactions or patterns are detected, you may receive alerts prompting you to review the activity and report any discrepancies.

It’s important to note that while the myccpay app takes significant measures to enhance financial security, it is also essential for users to practice good security habits. This includes regularly updating your password, keeping your login credentials confidential, and monitoring your account for any suspicious activity. If you have any concerns regarding the security of your myccpay account, you can reach out to the customer support team for assistance. For more information on accessing your myccpay account and managing your credit cards, visit our article on myccpay login and myccpay credit cards.

Embracing Convenience and Accessibility

In today’s fast-paced world, convenience and accessibility are essential when it comes to managing your finances. The myccpay app understands this need and offers a range of features that allow you to access your account anytime, anywhere. Additionally, the app provides customer support and assistance to ensure a seamless user experience.

Accessing Your Account Anytime, Anywhere

With the myccpay app, you can conveniently access your account details at any time, from the comfort of your own device. Whether you’re at home, at work, or on the go, the app gives you the flexibility to check your balances, view recent transactions, and monitor your credit card activity. This accessibility allows you to stay on top of your finances and make informed decisions wherever you are.

To access your account, simply log in to the app using your credentials. If you haven’t registered yet, you can easily create an account through the app or visit the login page on the myccpay website for more information.

Customer Support and Assistance

The myccpay app understands that good customer support is crucial in maintaining a positive user experience. If you have any questions, concerns, or issues while using the app, you can rely on their dedicated customer support team for assistance. They are available to help you navigate the app, address any technical difficulties, or provide general guidance related to your credit cards and account.

To get in touch with customer support, you can find the myccpay phone number on their website or through the app. They are ready to assist you and ensure that your experience with the app is smooth and hassle-free.

By embracing convenience and accessibility, the myccpay app empowers you to take control of your finances at your own convenience. Whether you need to check your account balances, monitor transactions, or seek assistance, the app provides a user-friendly platform that simplifies your financial management. Experience the ease and flexibility of the myccpay app and stay on top of your credit card accounts with just a few taps on your device.