Simplify Your Payment Process

Managing payments can be a hassle, especially when you have multiple accounts and bills to keep track of. Fortunately, myccpay is here to streamline your payment process and make your life easier. Let’s explore what myccpay is and the benefits it offers.

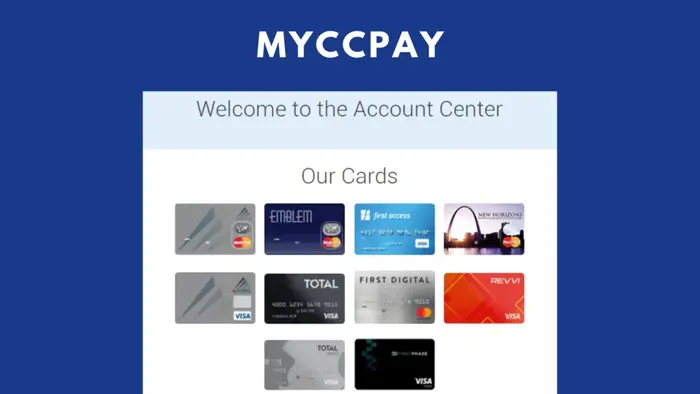

Introducing myccpay

myccpay is an online platform that allows you to conveniently manage and make payments for your credit cards. It provides a centralized hub where you can access and handle your various credit card accounts in one place. With myccpay, you no longer need to visit multiple websites or remember different login credentials. It simplifies the payment process by bringing all your credit card accounts together for easy management.

Benefits of Using myccpay

Using myccpay comes with several benefits that can enhance your payment experience and provide peace of mind. Here are some key advantages of using myccpay:

-

Convenience: With myccpay, you can access and manage your credit card accounts anytime, anywhere. Whether you’re at home or on the go, you have the flexibility to make payments and view your transaction history at your convenience.

-

Simplified Management: Instead of juggling multiple websites and login information, myccpay allows you to link your credit card accounts in one place. This centralized view makes it easier to track your payments, balances, and due dates, saving you time and effort.

-

Online Payment Options: myccpay provides various online payment options, allowing you to choose the method that works best for you. Whether you prefer one-time payments or setting up automatic payments, myccpay offers flexibility to suit your needs.

-

Payment Scheduling and Reminders: Keeping track of payment due dates can be challenging. myccpay simplifies this by allowing you to schedule payments in advance and set up reminders. This helps you stay on top of your payments and avoid late fees.

-

Transaction History: Accessing your transaction history is essential for budgeting and financial planning. With myccpay, you can easily view your past payments, allowing you to monitor your spending and keep track of your financial activities.

By utilizing myccpay, you can streamline your payment process and stay in control of your credit card accounts. It simplifies the management of your accounts, offers convenient payment options, and provides a centralized hub for all your credit card needs.

In the next section, we will dive deeper into the process of getting started with myccpay, including creating an account and linking your credit card accounts for seamless management.

Getting Started with myccpay

To streamline your payment process and stay in control of your finances, you can sign up for myccpay. This convenient online platform allows you to manage your payments efficiently and securely. Getting started with myccpay is a simple process that involves creating an account, completing the registration process, and linking your accounts.

Creating an Account

To begin using myccpay, you’ll need to create an account on the platform. Visit the myccpay website and look for the “Sign Up” or “Register” button. Click on it to start the account creation process.

During the account creation process, you’ll be required to provide some personal information, including your name, contact details, and account information. Make sure to enter accurate and up-to-date information to ensure a smooth registration process.

Registration Process

Once you’ve provided the required information, you will need to follow the registration process to complete your myccpay account setup. This may involve verifying your email address, creating a secure password, and agreeing to the terms and conditions of using myccpay.

Take the time to carefully read through the terms and conditions to familiarize yourself with the platform’s guidelines and policies. This will help you understand your rights and responsibilities as a myccpay user.

Linking Your Accounts

After successfully creating your myccpay account, the next step is to link your accounts. This allows you to view and manage your various credit card accounts in one centralized location. To link your accounts, you will need to provide the necessary details, such as your credit card number, account number, and any other required information specific to your credit card provider.

By linking your accounts, you can conveniently access and manage your credit card information, make payments, and view transaction history all from the myccpay platform.

For more information on the features and benefits of myccpay, including online payment options, payment scheduling, and viewing transaction history, refer to the section on features.

Now that you have created your myccpay account, completed the registration process, and linked your accounts, you are ready to take advantage of the streamlined payment process and stay in control of your finances. In case you encounter any difficulties or have questions about myccpay, you can reach out to their customer service for assistance. Check out our article on myccpay customer service for more information.

Features of myccpay

myccpay offers a range of convenient features that streamline your payment process and help you stay in control of your finances. Let’s explore some of the key features provided by myccpay.

Online Payment Options

With myccpay, you have the flexibility to make payments online, eliminating the need for traditional paper checks or manual processes. Through a secure online portal, you can conveniently pay your bills from the comfort of your own home. This not only saves you time and effort but also ensures that your payments are processed efficiently.

Payment Scheduling and Reminders

One of the benefits of using myccpay is the ability to schedule your payments in advance. This feature allows you to plan and organize your payments according to your preferred timeline. You can set up automatic payments for recurring bills or manually schedule payments for specific dates. Additionally, myccpay provides reminders to help you stay on top of your payment due dates, ensuring that you never miss a payment.

Viewing Transaction History

myccpay keeps track of your payment history, providing you with an overview of your transactions. You can easily view your payment records, including the date, amount, and recipient of each payment. This feature allows you to monitor your payment activity and maintain a clear record of your financial transactions.

To access these features and more, sign up for myccpay today. Visit our article on myccpay sign up for detailed instructions on how to create your account.

By utilizing the online payment options, scheduling and reminders, and access to transaction history provided by myccpay, you can simplify your payment process and gain better control over your financial management. If you have any questions or need assistance with myccpay, our customer service team is available to help.

Managing Your Payments

Once you’ve signed up for myccpay, you gain access to a range of convenient features that simplify the payment process. This section will cover how to set up automatic payments, update your payment information, and resolve any payment issues you may encounter.

Setting Up Automatic Payments

With myccpay, you have the option to set up automatic payments, which can help streamline your payment process and ensure you never miss a due date. To set up automatic payments, follow these simple steps:

- Log in to your myccpay account.

- Navigate to the payment settings or automatic payment section.

- Provide the necessary details, such as your preferred payment method (e.g., bank account or credit card) and the amount you wish to pay automatically.

- Select the frequency (e.g., monthly, bi-monthly) and the date you want the payment to be made.

- Confirm the setup and save your preferences.

By setting up automatic payments, you can have peace of mind knowing that your payments will be made on time, without the need for manual intervention. However, it’s important to ensure that you have sufficient funds in your designated payment account to avoid any issues.

Updating Payment Information

To keep your payment information up to date, myccpay provides a straightforward process for making changes. Follow these steps to update your payment information:

- Log in to your myccpay account.

- Navigate to the account settings or profile section.

- Locate the payment information tab.

- Select the option to update your payment method or card details.

- Enter the new information as prompted.

- Save the changes and ensure that the updated payment information is reflected in your account.

Regularly reviewing and updating your payment information can help prevent any disruptions or delays in your payment process. Remember to double-check the accuracy of the updated details before saving the changes.

Resolving Payment Issues

In some cases, you may encounter payment issues or discrepancies while using myccpay. If you experience any problems, it’s important to address them promptly to avoid any negative consequences. Here are a few steps to help you resolve payment issues:

- Review your transaction history within your myccpay account to identify any potential errors or discrepancies.

- If you notice any discrepancies, reach out to the merchant or financial institution associated with the payment to seek clarification.

- If the issue persists, contact myccpay customer support for further assistance. They can provide guidance on how to resolve the issue and ensure that your payments are processed correctly. You can find the contact details in our article on myccpay customer service.

By promptly addressing any payment issues, you can maintain control over your finances and ensure that your payments are accurately processed.

Managing your payments effectively is essential for staying on top of your financial obligations. With myccpay, you can take advantage of features like automatic payments, easy payment information updates, and support for resolving any payment issues that may arise. By leveraging these capabilities, you can streamline your payment process and stay in control of your finances.

Security and Support

When it comes to managing your payments online, security and support are essential considerations. myccpay prioritizes the safety of your transactions and provides reliable customer support to address any concerns or issues you may encounter.

Ensuring Secure Transactions

myccpay understands the importance of keeping your payment information secure. The platform utilizes advanced security measures to safeguard your personal and financial data. When you sign up for myccpay, you can rest assured that your information is protected through encryption and other industry-standard security protocols.

To further enhance security, it is crucial to follow best practices on your end as well. Make sure to choose a strong and unique password for your myccpay account. Avoid sharing your login credentials with anyone and be cautious when accessing your account on public or unsecured networks. By taking these precautions, you can help ensure secure transactions and protect your sensitive information.

Contacting myccpay Support

If you have any questions or encounter issues while using myccpay, their customer support team is readily available to assist you. Whether you need guidance with account setup, payment scheduling, or troubleshooting, the myccpay support team is dedicated to providing prompt and helpful assistance.

To contact myccpay support, you can visit their customer service page. From there, you will find contact information, including phone numbers and email addresses, to reach out to their support team. They are equipped to address a wide range of inquiries, from general account inquiries to specific technical issues.

Frequently Asked Questions

To provide additional support and address common queries, myccpay maintains a comprehensive list of frequently asked questions (FAQs). These FAQs cover various topics related to using myccpay, including account setup, payment management, and troubleshooting.

Some common questions you may find answers to in the myccpay FAQs include:

- How do I create an account on myccpay?

- How can I link multiple accounts to my myccpay profile?

- What are the available online payment options through myccpay?

- How do I schedule payments and set up reminders?

- What should I do if I encounter issues with my payment?

By referring to the FAQs, you can find answers to many common inquiries and gain a better understanding of how to make the most of myccpay’s features. For more specific or complex issues, reaching out to myccpay support directly is recommended.

As you navigate the myccpay platform, remember that their focus is on providing secure transactions and reliable support. By utilizing the resources available and following best practices for online security, you can streamline your payments with confidence.